What do investors value in a Searcher?

A search fund is an entrepreneurial path undertaken by one or two individuals, the “searchers”, who form an investment vehicle with a small group of aligned investors, some of whom become mentors, in order to search for, acquire, and lead a privately held company for the medium to long term, typically six to ten years.

There is no evidence of criteria that will screen searchers who are more likely to find a company. The way an investor ultimately makes a judgement about searchers is to see whether they have the courage to make lots of cold calls and be rejected a lot, are willing to get on a plane and meet with lots of sellers, and are able to form a relationship with a seller.

Table of Contents:

Who is a Searcher?

Search funds offer young and talented entrepreneurs the opportunity to secure funding and become equity-owning business operators. This can be funded by a group of investors who cover a nominal salary and expenses for a duration of two or more years while the searcher seeks out a suitable company for acquisition.

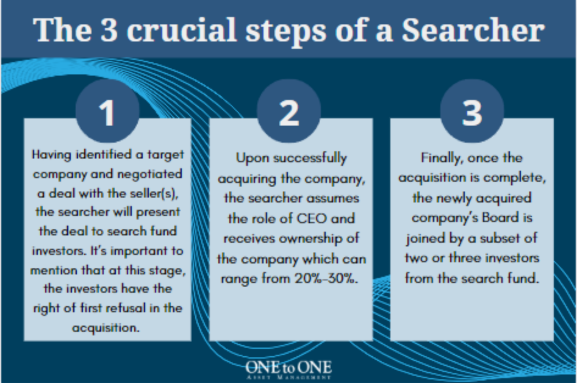

As a searcher, there are three crucial phases involved:

A searcher will typically work with two or three investors, who will provide valuable guidance, due diligence assistance and deal structuring advice.

What are the most valued characteristics of a good Searcher?

Although it is difficult for investors to pick the “right” entrepreneur upfront, there are a number of specific characteristics that they can look for.

Confidence yet humility:

The Searcher must be confident while also recognizing that they don’t know everything and show some humility. It is important to be open to advice and wisdom of experienced investors and not let youthful exuberance lead to bad decisions. The Searcher must show a willingness to listen and be eager to ask questions.

Honesty and transparency:

The searcher should treat the investors as partners, having frank and honest discussions about potential deals. They should be open and transparent at every phase of the journey.

Resilience, focus and discipline:

The search process can be demanding, requiring perseverance and resilience in the face of challenges and setbacks. Search fund investors want to back someone who is hungry, talented and focused, and possesses the tenacity to overcome obstacles, adapt to changing circumstances, and maintain focus on the ultimate goal.

Demonstrated Track Record:

Investors seek individuals who have displayed a history of success and accomplishment. Previous entrepreneurial experience, leadership roles, or notable achievements showcase a searcher’s ability to take on challenges, make sound decisions, be resourceful and drive results. This shows that the searcher has the necessary skills and resilience to navigate the complexities of the search process and successfully manage the acquired business.

Networking and Relationship-Building Skills:

Investors understand the importance of relationships in the business world. Searchers who possess strong networking and relationship-building skills have a distinct advantage in identifying potential sellers, advisors, and industry experts.

Strong Management and Leadership Skills:

Searches should possess strong management and leadership skills. Acquiring and operating a business requires effective leadership to navigate through various stages of growth and address potential hurdles. The ability to assemble and motivate a talented team, foster a positive work culture, and implement strategic initiatives is vital for long-term success

Industry Knowledge and Expertise:

Investors are attracted to searchers who demonstrate a deep understanding of the industry they plan to operate in. A comprehensive knowledge of the industry landscape, trends, competitors, and customer behaviour is invaluable when identifying potential acquisition targets.

Why is it important to invest in the right Searcher?

Investing in the right searcher is crucial for an investor as it will not only determine the revenue and growth potential of the acquisition but also the attractive returns that will be yielded in the future.

Thus, this is all dependent on the investors ability to choose the right searcher in order to invest in the acquisition.

Investing in a search fund is not a decision that should be taken lightly and requires careful consideration. The pivotal decision lies in choosing the searcher and whether they possess the right skills and abilities to carry out a successful acquisition.

The most successful investors have excelled in selecting the ideal investment opportunity and mentoring and guiding the searcher to foster an environment for success.

At ONEtoONE Great Searchers Fund, we invest in exceptional Searchers to become the next generation of great leaders.

Whether you are already a Searcher or are looking to become a Searcher, we are here to support you. We finance your search, invest in the acquisition, empower you to build a great business, and help you exit successfully, with our sole purpose being to devote our time to ensuring your success.